Behavioral Finance: How Emotions and Biases Shape Your Financial Decisions

Key Takeaways

· Emotions and biases might influence financial choices more often than most people realize.

· Behavioral patterns, such as loss aversion, familiarity bias, and herd mentality, can impact long-term results.

· Recognizing emotional triggers can help manage impulsive decisions.

· Guidance can help you recognize biases and potentially support clearer decision-making.

February is an interesting month in the financial calendar. The holiday excitement has faded, credit card bills from December have arrived, and tax season is in full swing. For some people, this is when the emotional weight of money can feel the heaviest.

Here is what is less often discussed: 43 percent of U.S. adults say money negatively impacts their mental health. Compared with other life stresses, such as political divisions, global events, or health concerns, financial concerns remain a leading source of mental strain. While financial stress has decreased over the past two years, inflation, interest rates, and overall economic uncertainty continue to make people feel anxious.1

Concerns about finances are not limited to a specific income level. Individuals across the financial spectrum experience money worries. The concerns may differ, but the emotional toll can be similar.

Money worries can be legitimate, but they can also be exaggerated. Regardless of their origin, these feelings can influence saving, spending, and investment decisions.

Over time, financial professionals have learned that even the most thoughtful strategy can fall short if it does not consider the human behind the numbers. Wealth management is not only about portfolio decisions. It also involves understanding the emotional relationship people have with money and investing, and helping them navigate that complexity. The field that studies this is called behavioral finance.

What Is Behavioral Finance?

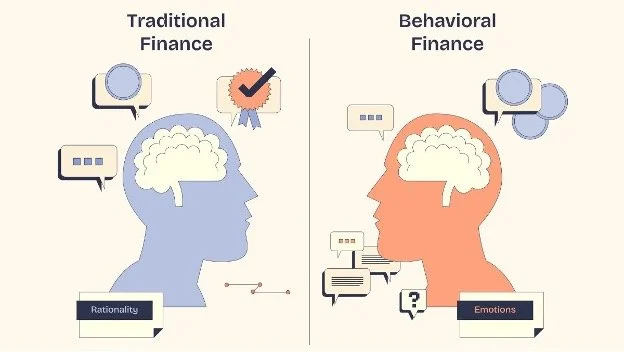

Behavioral finance is the study of how psychology influences investor behavior and, in turn, financial markets. The central idea is that investors do not always act in their own best interests, often making decisions shaped by biases or emotional responses. When enough investors react in similar ways, these psychological forces can influence market direction.2

For example, have you ever seen a headline that says, “Investor sentiment moved the market today?”

A related discipline, financial psychology examines the cognitive, social, and emotional factors that shape an individual’s relationship with money.2

While financial professionals are not psychologists, experience can help provide some insights worth sharing.

Why Do People Not Always Make Rational Money Decisions?

People do not always make rational financial decisions because behavior is shaped by limited information, ingrained biases, and emotion.

Some financial models assume that individuals act logically, rely on data, and naturally make prudent choices to manage risk while pursuing return. In reality, people are human, not calculators.2 Understanding this difference can help you with your own financial decision making.

What Biases Influence Financial Decision-Making?

Several well-documented biases influence financial decisions, often without people being aware of them. Beginning in the 1970s, Daniel Kahneman and Amos Tversky demonstrated that real-world financial decisions often rely on shortcuts rather than pure logic. For example, research shows that increased anxiety can change an investor’s willingness to bear risk.2

Common Behavioral Biases Include:

· Familiarity bias is the tendency to prefer investments that feel familiar.

· Loss aversion refers to the tendency to prioritize managing a loss rather than achieving gains.

· Confirmation bias is the tendency to seek information that supports an existing belief.2

· Experiential bias occurs when individuals heavily rely on past experiences to inform their current decisions and judgments. Although history provides a reference point, it is only one of many factors that should inform choices.3

· Recency bias leads people to rely too heavily on current trends, many of which are short-lived.3

· Herd mentality encourages individuals to follow the crowd, basing actions on what others appear to be doing rather than on informed analysis. In extreme cases, herd behavior can contribute to market extremes.2

How Can Behavioral Biases Affect Financial Outcomes?

Behavioral biases can impact financial outcomes because decisions are often driven by emotion rather than reason. Examples include:4

· Chasing trends, which may lead to buying high and selling low

· Excessive trading, which can increase costs

· Neglecting long-term objectives due to short-term emotions

How Do Emotions Influence Money Decisions?

Emotions influence financial decisions because they often reflect more than just numbers, affecting mental health, relationships, and day-to-day well-being. Negative emotions such as fear, anxiety, and insecurity can trigger impulsive or irrational behavior. Marketers, at times, intentionally activate these emotions to drive purchases.2

Recognizing emotional triggers and creating strategies to handle them can help improve financial decision-making over time.2

Common emotional triggers include:

· Fear of loss during market downturns

· Fear of missing out during sharp rallies

· Anxiety expressed through constant account monitoring

· Overconfidence after several positive outcomes

· Shame from past mistakes5

Emotional states can influence decisions in both positive and negative directions. Happiness can lead to excessive risk-taking, while sadness can cause a tendency to avoid all decisions.

Do High-Net-Worth Individuals Face Unique Behavioral Finance Challenges?

High-net-worth individuals often exhibit many of the same behavioral tendencies as others, although the emotional dynamics may be intensified by their more complex financial lives. Wealth does not eliminate biases or emotional responses.

Emotional challenges for wealthy individuals include:

· Difficulty trusting motivations

· Fear of being valued only for money

· Feeling disconnected from peers of different means

· Pressure to maintain appearances

· Concerns about entitlement among children

· Illiquid business and real estate assets can fluctuate in value and create financial pressures

· Fear of losing everything

What Behavioral Finance Strategies Can Help?

Behavioral finance strategies can help by introducing structure and objectivity that counterbalance emotional reactions. An experienced financial professional serves as a neutral party who can slow decision-making, broaden available choices, and help align actions with personal values.

Examples include:4

· Setting clear, realistic objectives and revisiting them regularly

· Encouraging focus on long-term direction rather than short-term noise

· Employing strategies to help manage risk

· Establishing “emotional circuit breakers,” such as short waiting periods before certain decisions

How Do the Head and the Heart Come Together in Financial Decision-Making?

The head and heart come together because money decisions reflect both logic and deeply rooted emotional experiences. Childhood influences, family attitudes, and early financial memories shape current behaviors. Recognizing that money carries emotional weight is an important step toward more effective decision-making, and support is available.

The strongest professional relationships in this field are not built solely on performance or financial outcomes, although these matters are important. They develop through understanding the whole person.

Your approach should serve your life, and your life includes emotions, relationships, hopes, fears, and everything in between. A financial professional’s role is not only to manage your money but also to help cultivate a healthy relationship with wealth that aligns with your values.

Ultimately, it is not just about the figures on an account statement. It is about the human behind them.

Sources:

1. PressReader.com, May 6, 2025.

https://www.pressreader.com/usa/marysville-appeal-democrat/20250506/281535116870676

2. PsychologyToday.com, November 2025.

https://www.psychologytoday.com/us/basics/behavioral-finance

3. Empower, August 23, 2024.

https://www.empower.com/the-currency/life/behavioral-finance

4. Ambani and Associates LLP, January 21, 2025.

https://www.linkedin.com/pulse/role-behavioral-finance-personal-wealth-management-llp-bhh8c/

5. Empower.com, April 10, 2025.

https://www.empower.com/the-currency/life/how-emotions-mood-influence-financial-behavior-news