Most resolutions fade fast. Here’s a simple, science-backed goal-setting process—SMART goals, accountability, and small wins—to make progress all year.

Read MoreLearn how financial anxiety, loss aversion, and other behavioral biases affect financial decisions and investing—and practical “circuit breakers” to stay focused long term.

Read MoreThe promise is everywhere: AI will increase your profitability, boost efficiency, and take your revenue to new levels. And yet, you've probably also seen the headlines saying that 95% of organizations implementing AI aren't seeing returns. Even Jeff Bezos recently said we're in an AI bubble where it's hard to tell the good ideas from the bad ones.

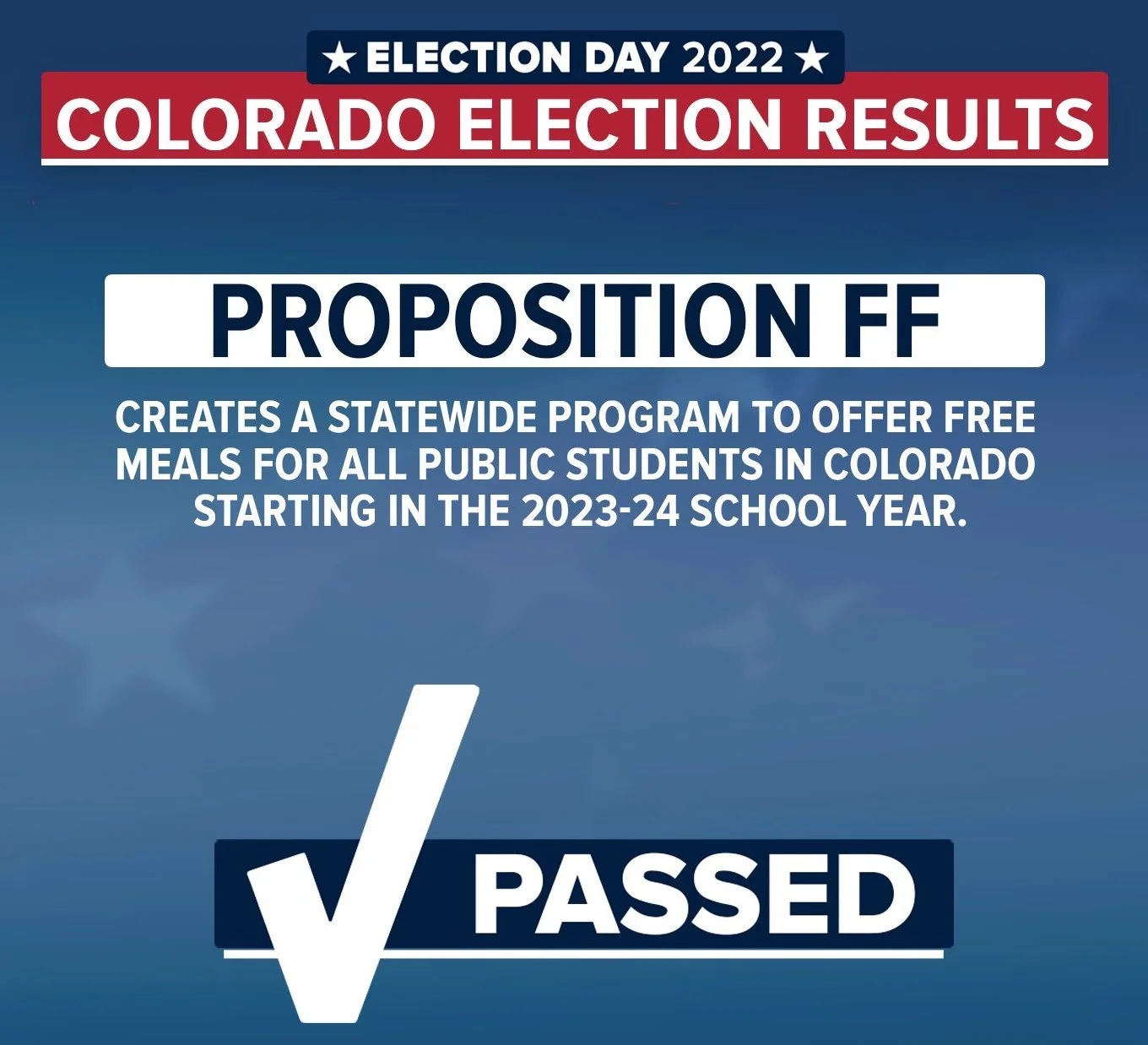

Read MoreOn November 8, 2022 Colorado voters approved Proposition FF creating a program to provide access to free meals to all public school students in Colorado. Funding for the program comes from an increase in state taxes on households with more than $300,000 in Federal adjusted gross income by limiting state income tax deductions. Colorado taxpayers have a number of options available to them to limit the impact of this higher tax.

Read MoreDo we know what creates a happy retirement or is it a mystery why some are happy and others are dissatisfied? A recent research report provides some good news for retirees as well as those who are still working.

Read MoreWhile every business is different here are some common deductions and tax strategies we explore with clients and their CPAs to reduce their taxes. We encourage business owners to explore these strategies with their own tax advisors.

Read MoreMany business owners and affluent families have excess cash in bank accounts as a result of strong economic growth since the 2020 downturn. While having excess cash can be a welcome situation it poses challenges on how to proceed. How should one invest in an environment of rising inflation, rising interest rates, and the war in Ukraine? Is the economic expansion over and markets are near a pullback? Is it better to reinvest in the business, distribute profits and diversify, or pay down debt? What to do with available cash is an important decision with long-term consequences.

Read MoreWhen the COVID-19 crisis struck, authorities quickly took steps to alleviate the fallout. The U.S. Federal Reserve eased monetary policy and made ample liquidity available. Federal and state governments introduced measures to assist impacted individuals and businesses. As time wore on, uncertainty receded, markets rebounded, and the U.S. economy recovered from the initial shock.

Read MoreNews of Russia’s invasion of Ukraine dominates recent headlines. At the time of writing the S&P 500 was down -2% at the market open but has recovered and is down -1%. European stock markets are down between -3% and -5%. Brent Crude oil prices jumped 6% and gold is up 10%. Technology stocks, as represented by the Nasdaq index, dropped 3% at open but recovered to be down modestly -0.4%. But how should investors think about military conflict and their portfolios?

Read MoreOur market and economic outlook for 2022 could be compared to a backcountry hike in the mountains – the scenery is nice but there are risks. Investors have a favorable economic backdrop with almost all developed economies in expansion. However, bad weather threatens with inflation at a 40 year high, the potential for higher interest rates and stock market volatility, high valuations for stocks and bonds and the continuing impact of COVID-19 on labor and supply chains. Investors can adjust their equity and bonds holdings to respond to these threats and consider alternative assets that may provide protection from down markets while offering growth.

Read MoreI believe many investors today are like gold medal winners during competition: anxiously watching the scoreboard to see if things will turn out well or something unexpected will happen. Will COVID variants, inflation, or a stock market crash ruin a period of great twelve month returns? We think the economic and market trends are positive but higher valuations and the threat of higher inflation may mean investors should make some adjustments.

Read MorePaying for college is a top financial concern for many families. In 2015 a Gallup poll found for the first time that parents identified paying for college as their primary financial concern. It showed that 73% of families with children under 18 worried about paying for college. Concern over college costs has continued as parents also report higher levels of concern over paying for college since the COVID pandemic. It’s easy to understand why parents are concerned. Data shows that college costs are up 33% since 2000. New changes to Colorado and US laws could make it harder for families to pay for college.

Read MoreWho will win the Presidential Election and control congress? This is an important question for wealthy investors and taxpayers because it could have a major impact on their current and future tax bills. Because tax policy is so politically charged, neither candidate is likely to accomplish much without his party’s full control of congress. If Joe Biden becomes president and has a Democratic Congress behind him there could be extraordinary changes in tax policy. Based on Biden’s proposals these changes could mean significantly higher taxes for wealthy taxpayers. These taxpayers may want to contact their tax advisor and estate attorney now to discuss taking action.

Read MoreIt seems the COVID-19 Coronavirus is affecting every facet of life since it emerged as a global pandemic in 2020. It dominates news coverage and daily conversation. While this pandemic is the subject of intense scrutiny and interest, we believe that there are two additional but largely invisible epidemics affecting the world and impacting businesses, jobs, investments, and lives: the narrative of negativity and the epidemic of isolation. While COVID-19 is a physical epidemic, the other two may be just as important for investors who want to navigate the volatile stock market and achieve their long-term goals.

Read MoreThe lockdowns in response to the Coronavirus will likely have a strong negative impact on a large number of businesses and employees across the United States. Many employees may be facing economic hardship as a result of school closures or the loss of income of a spouse or partner. The Coronavirus Aid, Relief, and Economic Security Act (CARES) contains numerous provisions to help employee participants of qualified retirement plans. These provisions are optional for plan sponsors and they may adopt whichever provisions they choose.

Read MorePresident Trump signed the Coronavirus Aid, Relief, and Economic Security Act (commonly known as the CARES Act) into law on Friday, March 27 in response to the economic impact of COVID-19 on American businesses, jobs, and the economy. It provides an estimated $2 trillion of financial support through checks to families, loans to businesses, and support for severely impacted sectors of the economy.

Read MoreStock markets have tumbled over the past few days and many observers have blamed the Coronavirus for the selling. The S&P 500 is down -8% from 2/19 to 2/26 with other equity indices experiencing similar movements. News outlets are filled with reports of the Coronavirus and its potential impact on the global economy and stock markets. How should investors with a long-term horizon respond?

Read MoreStarting a new business can be a whirlwind of activity and emotions. There’s the euphoria of finally taking steps you’ve dreamed of, the rush of seeing your business name in print and on the web for the first time, and the fear when things are different than you expect, or early plans don’t go well.

While we agree that starting a business demands your full attention, there are simple steps entrepreneurs can take to help protect themselves, their finances, and their loved ones. This checklist provides a list of questions to work through with your loved ones and advisors.

Read MoreMany business owners feel their tax burdens are too high and a headwind for growing their business and personal income. Some aspects of the tax code, such as paying both the employer and employee FICA payroll taxes (for Social Security, Medicare, and Medicaid funding) increase the tax bite for business owners. I’ve spoken with a number of entrepreneurs who would gladly expand their workforce and operations if they could legally reduce their taxes. We’ve compiled the following list of tax planning strategies that include the changes from the Tax Cut and Jobs Act (TCJA) of 2017 for owners to evaluate with their tax advisors.

Read MoreFall is such a wonderful time of year with the shorter days and cooler nights, the glimpses of color in the yards and across the hillsides. Summer is officially over, the squirrels are busy storing away nuts and folks all around town are digging through closets, finding anew their jackets and overcoats.

Just as humans and animals are preparing for colder temperatures and winter storms we think investors should be prepared for market winds as economic growth slows in 2019 until it resumes in the second half of 2020. This slowdown, combined with political and trade uncertainties, will likely continue to buffet markets.

Read More