Top 2020 Tax Planning Strategies for Business Owners

In our experience many business owners feel their tax burdens are too high and a headwind for growing their business and personal income. Some aspects of the tax code, such as paying both the employer and employee FICA payroll taxes (for Social Security, Medicare, and Medicaid funding) increase the tax bite for business owners. I’ve spoken with a number of entrepreneurs who would gladly expand their workforce and operations if they could legally reduce their taxes. We’ve compiled the following list of tax planning strategies that include the changes from the Tax Cut and Jobs Act (TCJA) of 2017 for owners to evaluate with their tax advisors.

1. Claim 100% bonus depreciation for asset additions

The TCJA allows a 100% first-year bonus depreciation for qualified new and used property that is acquired and placed in service in calendar year 2020 and before January 1, 20231. Your business may be able to write off the entire cost of some or all of your asset additions on this year’s return. Contact your tax advisor to discuss what property is eligible but examples include some building improvements, computers, software, machinery, equipment, and office furniture.

2. Claim 100% bonus depreciation for heavy SUV, pick-up or van

The 100% bonus depreciation provision can have a large beneficial impact on first-year deductions for new and used heavy vehicles that are used over 50% for business and placed into service between September 28, 2017 and December 31, 2022. That’s because heavy SUVs, pick-ups, and vans are treated for tax purposes as transportation equipment, qualifying them for 100% bonus depreciation. The definition of a heavy vehicle is a gross vehicle weight rating (GVWR) over 6,000 pounds. You can verify the GVWR by looking at the manufacturer’s label, which is usually located on the inside edge of the driver’s side door.2 If you’re considering whether to buy an eligible vehicle for yourself or your employees it may create a nice write-off for this year’s return.

3. Consider a Cost Segregation study for buildings

Cost Segregation studies allow businesses to carefully examine their properties and shorten their depreciation time for tax purposes. By shortening the depreciation time for qualified assets business owners incur a higher annual depreciation expense and lower their tax bill. Cost Segregation studies are an engineering-based approach to allocate building costs among the various building components to maximize depreciation expense by classifying qualified assets into shorter lives. IRS rules generally allow businesses to depreciate commercial buildings over 39 years. Often a business will depreciate the structural components (walls, windows, HVAC, plumbing, wiring, etc.) with the same depreciation life. A cost segregation study identifies and reclassifies a building’s non-structural elements, land improvements, and indirect construction costs to identify those items that can be depreciated over a shorter tax life from the building itself. For example, a building’s walls, flooring, ceiling, and plumbing can be depreciated over shorter time frames, such as 5, 7, and 15 years, than the standard depreciation of 39 years for non-residential real property. These benefits are now even greater with the Tax Cut & Jobs Act.3

Cost Segregation studies involve working with your tax advisor and a qualified engineering firm. The engineering firm performs a non-invasive inventory and review of your building and property and classifies each item according to its proper depreciation time. The studies often cost between $8,000 and $15,000 and can yield significant tax savings.4 Contact your tax advisor to discuss whether a cost segregation study could benefit your business.

4. Cash in on more generous Section 179 deduction rules

For qualifying property placed in service in tax years beginning in 2018, the TCJA almost doubled the maximum Section 179 deduction to $1 million (up from $510,000 for tax years beginning in 2017). 5 More favorable treatment for property used for lodging and qualifying real property were added. Be sure to consult with your tax advisor on the various limitations of Section 179 deductions given your corporate structure.

5. Maximize the new deduction for pass-through business income

The new deduction based on qualified business income (QBI) from pass-through entities was a key element of the TCJA tax reform. For tax years 2018-2025, the deduction can be up to 20% of a pass-through entity owners qualified business income, subject to restrictions that apply at higher income levels and restrictions on the owner’s taxable income. For QBI pass-through entities are defined as sole proprietorships, single-member LLCs, partnerships, LLCs that are treated as partnerships for tax purposes, and S corporations. The QBI deduction can also be claimed for up to 20% of income from qualified REIT (real estate investment trust) dividends and 20% of qualified income from publicly-traded partnerships.6 Because of the various imitations on the QBI deduction and the potential costs of changing your corporate structure, consult with your tax advisor to evaluate this deduction for your business.

6. Establish or expand a retirement plan

If your business doesn’t yet offer a retirement plan you might consider establishing one. Current rules allow for significant contributions to retirement plans that reduce current year taxable income. For example, if you are self-employed you can establish a SEP-IRA and contribute up to 20% of your earnings, up to $57,000 in 2020. If you are employed by your own corporation up to 25% of your salary can be contributed to your own account, up to $57,000 using a solo 401(k). If you are 50 or older you can increase the annual savings amount to $63,000.7

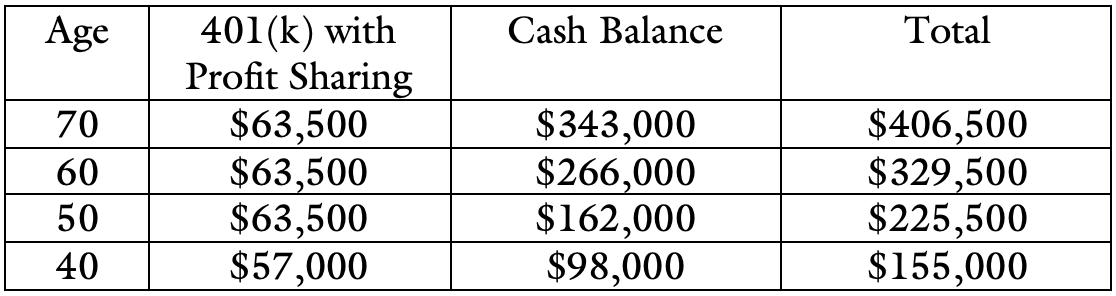

You can also consider adding a defined benefit cash balance plan. This is a type of qualified retirement plan that allows business owners to save far more than an IRA or 401(k)s alone. The contribution amounts are based on the age of the owner(s) with older participants able to accumulate more. By combining a 401(k), profit-sharing, and cash balance plans business owners could save significant amounts each year. The 2020 limits are:8

The plan specifies an annual contribution amount based on a formula. Business owners who are older than 40, would like to contribute more than the annual maximum of $57,000, are willing to contribute to employee’s retirement, and have consistent revenue and profits may be candidates for a cash balance plan.

7. Make multi-year charitable gifts in one year

The Tax Cut & Jobs Act significantly increased the personal standard deduction ($12,400 for an individual or $24,800 for a married couple in 2020). The standard deduction provides a simple way for taxpayers to reduce their taxes. However, one effect of increasing the standard deduction was to remove the benefit of many personal itemized deductions. One example of this is charitable deductions. They are only deductible as itemized deductions. In order to itemize, taxpayers need combined itemized expenses for the tax year to be greater than their standard deduction amount (see above).9

Generally, itemized deductions in 2020 include medical/dental expenses (which include only those expenses paid which are greater than 7.5% of gross income); state and local income and property taxes (but not more than $10,000 each year); home mortgage interest (limited to interest on acquisition indebtedness of $750,000; $1,000,000 for debt acquired before 2018); and charitable gifts (60% annual AGI for cash; 50%, 30% or 20% limits on other property items, depending on what type of charitable organizations the assets are given to and whether the asset is ordinary income property or capital gain property); and casualty losses (with limitations) Unfortunately, the TCJA eliminated the deduction for miscellaneous itemized deductions for tax years 2018 through 2026.10

Taxpayers can itemize their charitable gifts (and other personal deductions) by strategically giving more to charities in certain years. By making multi-year charitable gifts taxpayers can aim to go beyond their standard deduction and receive the benefit of their charitable gift that year.11 For example, if a married business owner generally makes charitable gifts of $10,000 per year they could make a $30,000 charitable gift in one year and itemize it on their taxes because it is over their standard deduction (assuming no other itemized deductions). They would then not make charitable gifts in the next two years and take the standard deduction.

One way to make multi-year gifts is to use a Donor-Advised Fund. These funds are sponsored by 501(c)3 approved charities and receive charitable gifts in a given tax year and allow donors to distribute the funds in future years at the donor’s request.12 So, in our illustration above, if a business owner made a contribution of $30,000 to a donor-advised fund she would receive the current year tax deduction the $30,000 contribution. She could then distribute the funds in portions of $10,000 per year over the next three years to continue supporting her preferred charities in a consistent manner. Business owners can speak with their tax advisor about their itemized deductions for this year and if it makes sense to make a multi-year charitable gift directly to a charity or using a tool such as a Donor-Advised Fund.

8. Offer fringe benefit plans for employees

Additional wages trigger employment tax costs for businesses, but if the business pays for some fringe benefits for employees these taxes can be mitigated, which is another way to reduce your taxable income. Tax-exempt benefits you can consider offering to employees include:

- Health benefits

- Long-term care insurance

- Group term life insurance

- Disability insurance

- Educational assistance

- Dependent care assistance

- Transportation benefits

- Meals provided for employee convenience

The IRS has a helpful publication on the tax benefits of fringe benefit plans “Employers Tax Guide to Fringe Benefits” (IRS Publication 15-B, 2020)13

9. Consider the Research & Development tax credit

The Federal R&D tax credit, also known as the Research and Experimentation (R&E) tax credit, was first introduced in 1981. Its purpose is to reward U.S. companies for increasing their involvement in R&D in the current tax year. President Obama signed the PATH act of 2015 that expanded many of the aspects of this credit. It is available to any business that attempts to develop new, improved, or technologically advanced products or trade processes. The credit may also be available to taxpayers that have improved upon the performance, functionality, reliability, or quality of existing products or trade processes. The IRS outlines specific types of Qualified Research Expenses (QRE) that can include wages to employees, supplies, contract research expenses, and basic research expenses paid to qualified educational institutions. Taxpayers must show that the activities are intended to resolve technological uncertainty; rely on hard science (such as engineering, computer science, biological science, or physical science), relate to the development of a new or improved business component, and constitute a process of experimentation involving testing and evaluation of alternatives.14

10. Investigate State incentives and credits

Many states offer businesses incentives and credits to encourage economic growth and encourage specific business growth and activity. While these programs can be challenging to find and understand they can provide access to low-cost financing, tax credits, and grants. For example, Colorado offers Enterprise Tax zone credits, access to low-cost financing, and sales tax refunds. Businesses in Colorado can access a comprehensive list of State programs here: https://choosecolorado.com/doing-business/incentives-financing/alphabetical-listing-programs/.

These strategies can help owners engage in proactive tax planning and help grow their businesses. As with all tax planning strategies, it is important to consult with your tax professional and advisory team to evaluate them carefully. If you’re interested in how we help clients coordinate their personal and business tax planning please contact us at info@scwealthplanning.com for a complimentary consultation.

Advisory services are offered through Summit Hill Wealth Management, LLC, a Registered Investment Advisor in the State of Colorado. Summit Hill Wealth Management, LLC does not provide tax and/or legal advice.

Sources

IRS, https://www.irs.gov/newsroom/tax-law-offers-100-percent-first-year-bonus-depreciation

Section 179.org, https://www.section179.org/section_179_vehicle_deductions/

Bedford Cost Segregation, https://www.bedfordteam.com/frequently-asked-questions/

Kravitz Back Office Solutions, https://www.cashbalancedesign.com/resources/contribution-limits/

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020

Tax Policy Center, Urban Instute & Brookings Institution, https://www.taxpolicycenter.org/briefing-book/how-did-tcja-change-standard-deduction-and-itemized-deductions

IRS, https://www.irs.gov/pub/irs-tege/donor_advised_explanation_073108.pdf

CPA Journal, October 2017, https://www.cpajournal.com/2017/10/30/u-s-research-development-tax-credit/